Understanding China's Real Estate Market in 2024: Trends and Challenges

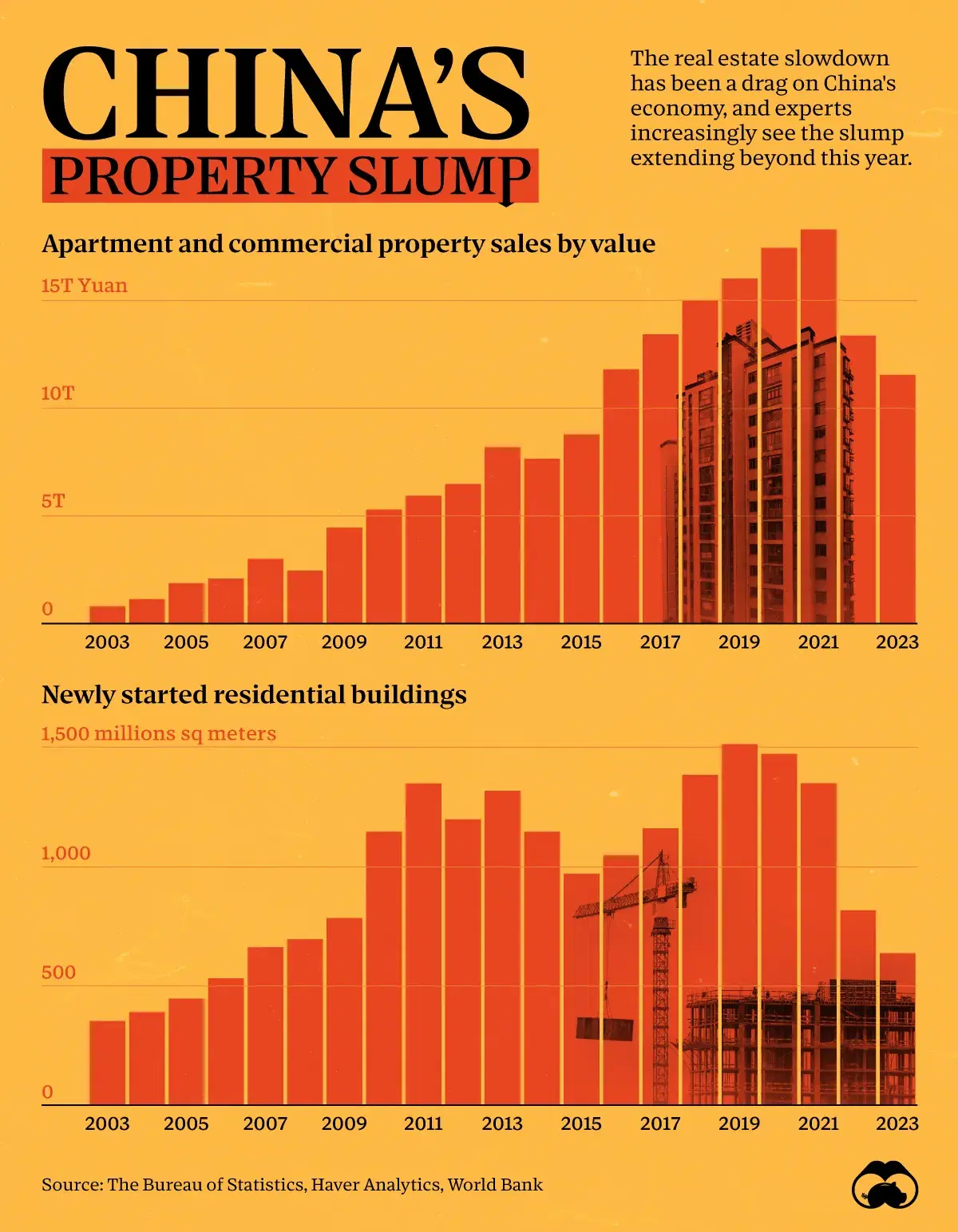

China’s real estate market has long been a critical pillar of the country’s economic growth. However, in recent years, it has faced significant shifts, including government interventions, rising debt concerns, and changing consumer behavior. As we look toward 2024, the landscape continues to evolve, with both opportunities and risks for investors, developers, and homebuyers alike.

In this guide, we’ll explore the key factors shaping China’s real estate market in 2024, from government policies to housing demand and market risks, providing you with a comprehensive understanding of where the market is headed.

The Role of Real Estate in China’s Economy

China’s real estate sector plays an outsized role in the country’s economy, contributing approximately 29% of its GDP. For decades, rapid urbanization and a growing middle class fueled an unprecedented property boom. Real estate has been a key investment vehicle for Chinese families, often seen as a safer bet than volatile stock markets.

However, the heavy reliance on property for economic growth has raised concerns about sustainability, with a rising debt burden in the sector and the growing threat of a housing bubble. In recent years, the Chinese government has taken steps to regulate the market and control the risks.

Key Trends Shaping China’s Real Estate Market in 2024

1. Government Policies and Regulations

One of the most significant factors impacting China’s real estate market is government intervention. The Chinese government has implemented a series of policies aimed at cooling down an overheated market and addressing the systemic risks posed by high levels of debt.

Key policy measures include:

- “Three Red Lines” Policy: Introduced in 2020, this policy sets limits on the debt levels that property developers can take on, based on metrics like debt-to-asset ratios. Developers who violate these limits face restrictions on borrowing, putting pressure on highly leveraged companies.

- Mortgage Restrictions: The government has tightened lending standards for homebuyers, particularly in larger cities, in an effort to curb speculative investment. Higher down payment requirements and restrictions on multiple home purchases have cooled demand.

- Local Government Interventions: Different cities have enacted localized policies to manage housing prices, such as purchase limits and price caps on new developments.

These regulations are expected to continue shaping the market in 2024, with the government’s primary goal being to stabilize housing prices and prevent speculative bubbles, while ensuring housing affordability for its citizens.

2. Shifting Housing Demand

China’s housing demand is undergoing significant changes, driven by demographic shifts, urbanization, and evolving consumer preferences. While urbanization remains a powerful force, the dynamics are changing as the population ages and birth rates decline.

- Aging Population: China’s rapidly aging population is likely to reduce long-term housing demand. Fewer young buyers are entering the market, and demand for smaller, more affordable housing may rise, particularly in second- and third-tier cities.

- Urbanization in Smaller Cities: While major cities like Beijing, Shanghai, and Shenzhen remain key real estate hubs, growth is shifting to smaller cities as the government encourages the development of second- and third-tier urban centers. These cities offer more affordable housing and are attracting young families and workers.

- Luxury vs. Affordable Housing: There’s a growing divide between demand for luxury properties in top-tier cities and the need for affordable housing for the middle class. Developers are increasingly focusing on building affordable housing to meet government targets and address the housing needs of lower-income buyers.

3. Rise of Sustainable and Smart Cities

Sustainability and smart technology are playing an increasingly important role in the future of China’s real estate market. The government has placed a strong emphasis on developing green buildings and smart cities as part of its broader goals to reduce carbon emissions and improve urban living standards.

- Green Buildings: Developers are integrating eco-friendly designs and energy-efficient technologies into new projects, particularly in large urban centers. These buildings not only reduce environmental impact but also appeal to younger buyers who prioritize sustainability.

- Smart Cities: Major cities like Shenzhen and Hangzhou are at the forefront of smart city development, incorporating technologies like 5G, IoT (Internet of Things), and AI to improve urban management, traffic systems, and housing efficiency.

As cities become more tech-driven and sustainable, developers and investors focusing on this trend could find themselves well-positioned for long-term success in China’s real estate market.

Risks and Challenges Facing China’s Real Estate Market

1. Property Developer Debt Crisis

One of the biggest risks facing the real estate market in China is the debt crisis affecting property developers. Many major developers, including Evergrande, have accumulated massive debt over the years, leading to liquidity crises that threaten not only the companies themselves but also the wider market.

The “three red lines” policy has put further pressure on these developers, limiting their ability to borrow and pushing some companies toward default. As a result, there is a risk that more developers may face financial difficulties in 2024, leading to delays or cancellations of projects and affecting homebuyers.

2. Housing Affordability and Income Inequality

While the property market in China’s top-tier cities remains strong, housing affordability has become a growing concern. In cities like Beijing and Shanghai, property prices have soared beyond the reach of many middle-class families, exacerbating income inequality.

The government has introduced measures to address these affordability issues, such as encouraging the development of rental housing and public housing schemes. However, the gap between the wealthy and the average homebuyer continues to be a challenge, especially in larger cities.

3. Economic Slowdown and Global Factors

China’s real estate market is closely tied to the broader economy, and any slowdown in economic growth could have significant repercussions for the property sector. Factors such as global supply chain disruptions, trade tensions, and monetary policy changes could all impact housing demand and developer finances.

Moreover, changes in global interest rates and investment trends could affect the flow of foreign capital into China’s real estate market, which has historically attracted significant international investment.

Investment Opportunities in China’s Real Estate Market

Despite the challenges, there are still opportunities for investors in China’s real estate market, particularly in areas aligned with government priorities or in high-growth regions.

1. Second- and Third-Tier Cities

As major cities become increasingly unaffordable, many young families and workers are turning to second- and third-tier cities for more affordable housing. Cities like Chengdu, Wuhan, and Chongqing are experiencing rapid growth and offer potential for long-term real estate appreciation.

2. Rental and Affordable Housing

The Chinese government is placing a strong emphasis on increasing the supply of affordable and rental housing. Developers who focus on this segment of the market are likely to benefit from both government incentives and strong demand from middle-class and lower-income families.

3. Sustainable and Tech-Driven Developments

Investors looking for long-term growth should consider projects focused on sustainability and smart city technologies. These developments align with both consumer demand and government priorities and are expected to grow in prominence over the coming years.

Conclusion

The China real estate market in 2024 is shaped by a mix of regulatory changes, shifting consumer demand, and emerging technologies. While there are challenges ahead, such as the ongoing debt crisis among developers and concerns about affordability, there are also significant opportunities for growth, especially in smaller cities and the affordable housing segment.

Investors and homebuyers alike should remain mindful of the evolving policy landscape and economic factors that could impact the market. By focusing on sustainable development, government-supported initiatives, and regions poised for growth, you can make informed decisions in navigating China’s dynamic real estate sector.

Are you ready to explore opportunities in China’s real estate market? Keep these trends in mind and take the first step towards a successful investment strategy.

comments powered by Disqus