How Do Airdrops Impact the Value of the Cryptocurrency Being Distributed?

How Do Airdrops Impact the Value of the Cryptocurrency Being Distributed?

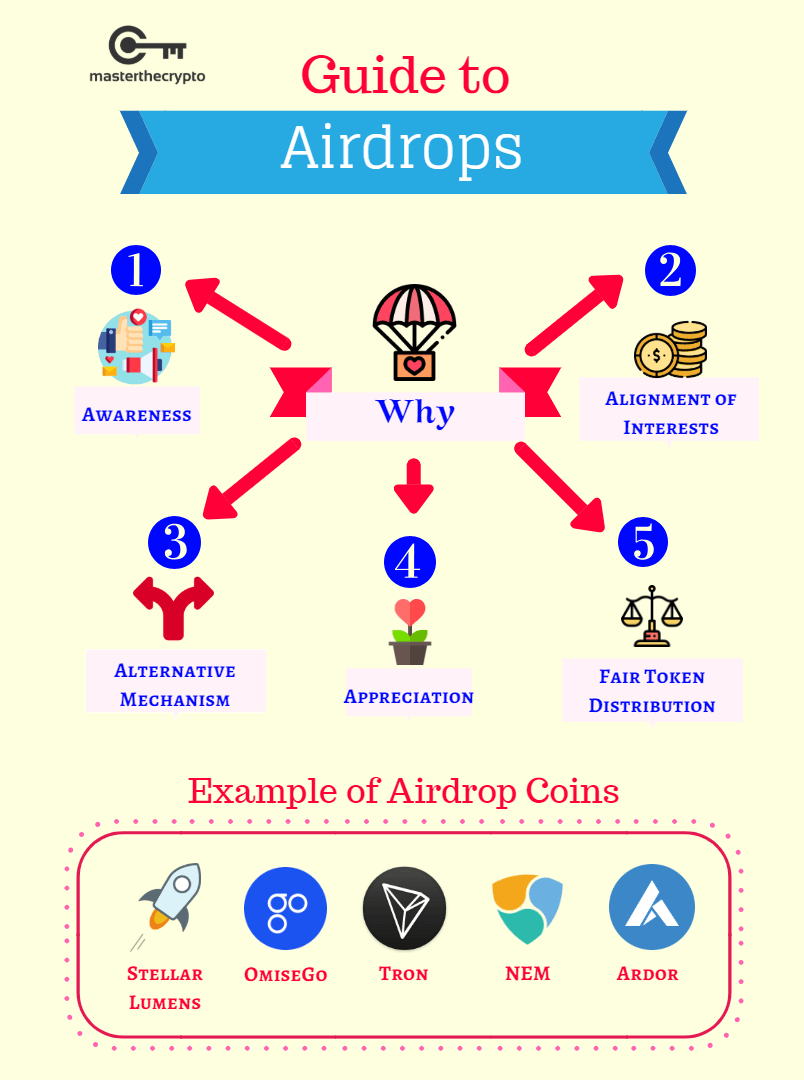

Airdrops are a popular marketing strategy in the cryptocurrency world, designed to distribute tokens to users for free or in exchange for simple tasks. They help raise awareness of a new token, incentivize engagement, and grow a community around a project. But the big question is: how do airdrops impact the value of the cryptocurrency being distributed?

Airdrops can either boost or hurt the value of a token, depending on how they’re executed. In this blog, we’ll break down the different factors at play and explore both the positive and negative effects airdrops can have on a cryptocurrency’s price.

The Problem: Airdrops Can Lead to Immediate Price Drops

One of the biggest challenges with airdrops is that they often cause a short-term price drop. Here’s why:

When a project distributes a significant number of tokens for free, many recipients are quick to sell them off, especially if they don’t have a vested interest in the project. This sudden influx of sell orders can flood the market, causing the token’s price to drop.

Example:

Let’s say a project airdrops 10,000 tokens to 1,000 users. If a large portion of these users decide to sell their tokens immediately, it increases the supply on the market, leading to a drop in the token’s value. This is particularly common in cases where the recipients don’t fully understand the long-term vision of the project and simply see the tokens as “free money.”

- Tip: Projects can combat this by using vesting schedules for airdropped tokens, meaning recipients can only sell a portion of their tokens at a time. This can help prevent a massive sell-off immediately after the airdrop.

The Positive Side: Airdrops Can Increase Long-Term Value

While the initial effects of an airdrop may lead to a price drop, the long-term effects can be beneficial if the project is successful in building a loyal community. Airdrops help create brand awareness and attract new users, who may then invest further in the project. This can drive up demand over time, especially as the project grows.

Example:

Take Uniswap’s airdrop in 2020. Uniswap, a decentralized exchange, airdropped UNI tokens to early users of the platform. While there was some initial selling, many recipients held onto their tokens, and as Uniswap’s platform grew in popularity, so did the value of the UNI token. In the long term, the airdrop helped solidify the project’s community and increase the token’s market value.

- Tip: The more successful the project becomes post-airdrop, the more valuable the tokens can become, especially if recipients are incentivized to hold rather than sell.

Community Building and Engagement

One of the biggest benefits of an airdrop is its ability to build a community around a project. When people receive free tokens, they become more invested in the project’s success. They are likely to follow the project’s updates, participate in governance if it’s a DAO (Decentralized Autonomous Organization), and even share information with others, further increasing the token’s visibility.

Example:

Airdrops can serve as a way to reward early adopters or loyal community members. This helps foster long-term engagement. In the case of Ethereum Name Service (ENS), they airdropped ENS tokens to people who had bought Ethereum domain names. The result? Increased community participation and governance voting on the future of the project.

- Tip: Airdrops that are tied to active participation—such as staking, voting, or contributing to the project—tend to have a more positive impact on long-term value because they encourage users to stay involved.

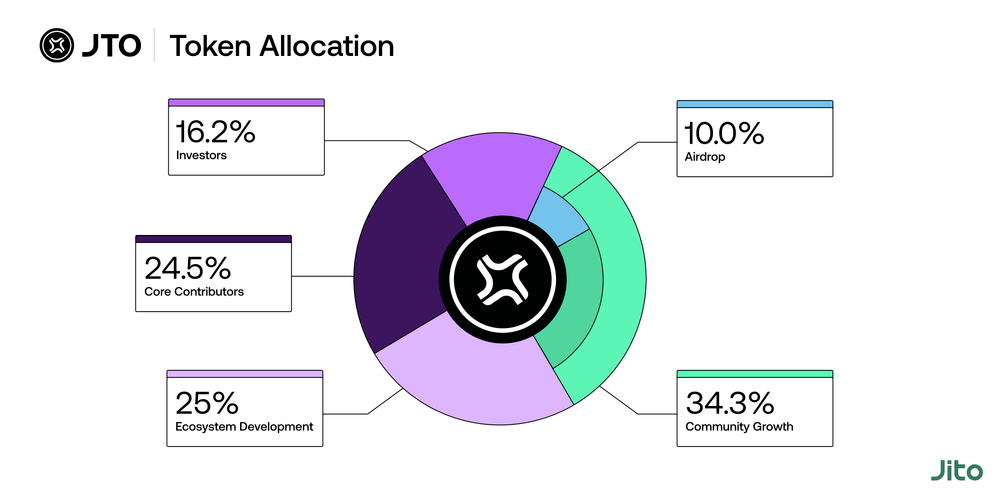

The Impact on Token Distribution and Decentralization

Another potential upside of airdrops is their role in decentralizing token ownership. By distributing tokens to a wide range of users, projects can ensure that the token’s power and influence are not concentrated in the hands of a few large investors. A more decentralized ownership structure can lead to a healthier ecosystem, where decisions are made collectively, and manipulation by large holders (also known as whales) is minimized.

Example:

Sui and Aptos are newer projects that have used airdrops to ensure their tokens are distributed across a broad base of users, increasing decentralization. This helps avoid a situation where a small group of people holds all the tokens and controls the network.

- Tip: Decentralized ownership helps build trust in a project, which can have a positive impact on token value as more users feel confident in the fairness of the system.

The Role of Speculation in Airdrops

Let’s not forget that speculation plays a big role in the cryptocurrency world. Airdrops often generate hype around a project, causing people to buy the token in anticipation of future growth. This can lead to a price surge before the airdrop, as investors try to get in early. However, this price increase is often followed by a post-airdrop dump, where recipients sell their tokens and cash out, leading to a decline in value.

Example:

During Aptos’ airdrop in 2022, there was a spike in buying activity leading up to the airdrop. However, shortly after the tokens were distributed, many holders sold, and the price experienced a correction.

- Tip: For projects, managing this speculative cycle is key. Clear communication about the long-term goals of the project and how the airdrop fits into those goals can help prevent a massive sell-off after the airdrop.

Conclusion: The Dual Nature of Airdrops on Token Value

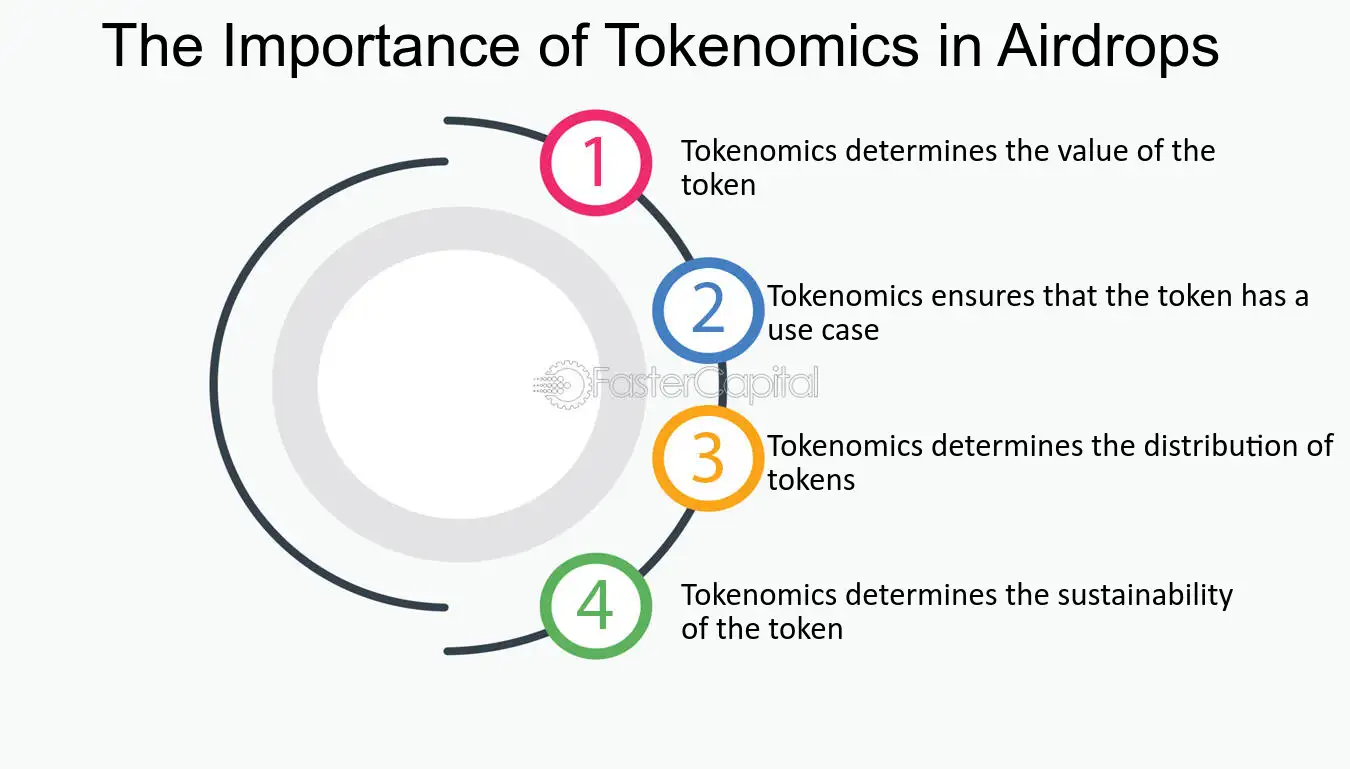

Airdrops are a powerful tool for building awareness and distributing tokens, but they come with risks, especially regarding short-term price drops. While they can temporarily reduce the value of a cryptocurrency due to mass selling, their long-term impact can be positive if they successfully build a community and drive engagement.

Projects should consider how they structure airdrops, using mechanisms like vesting schedules and rewarding active participation to maximize the long-term benefits. For investors, understanding the project’s goals and the role of the airdrop can help navigate the volatility that often accompanies these events.

Want to learn more about crypto marketing strategies? Subscribe to our blog for insights.

comments powered by Disqus