How Do Transaction Fees Affect Bitcoin Miners' Profitability?

Transaction fees play a critical role in the profitability of Bitcoin mining, particularly as block rewards decrease over time due to halving events. Here are the main ways transaction fees impact miners’ profitability:

1. Supplementing Block Rewards

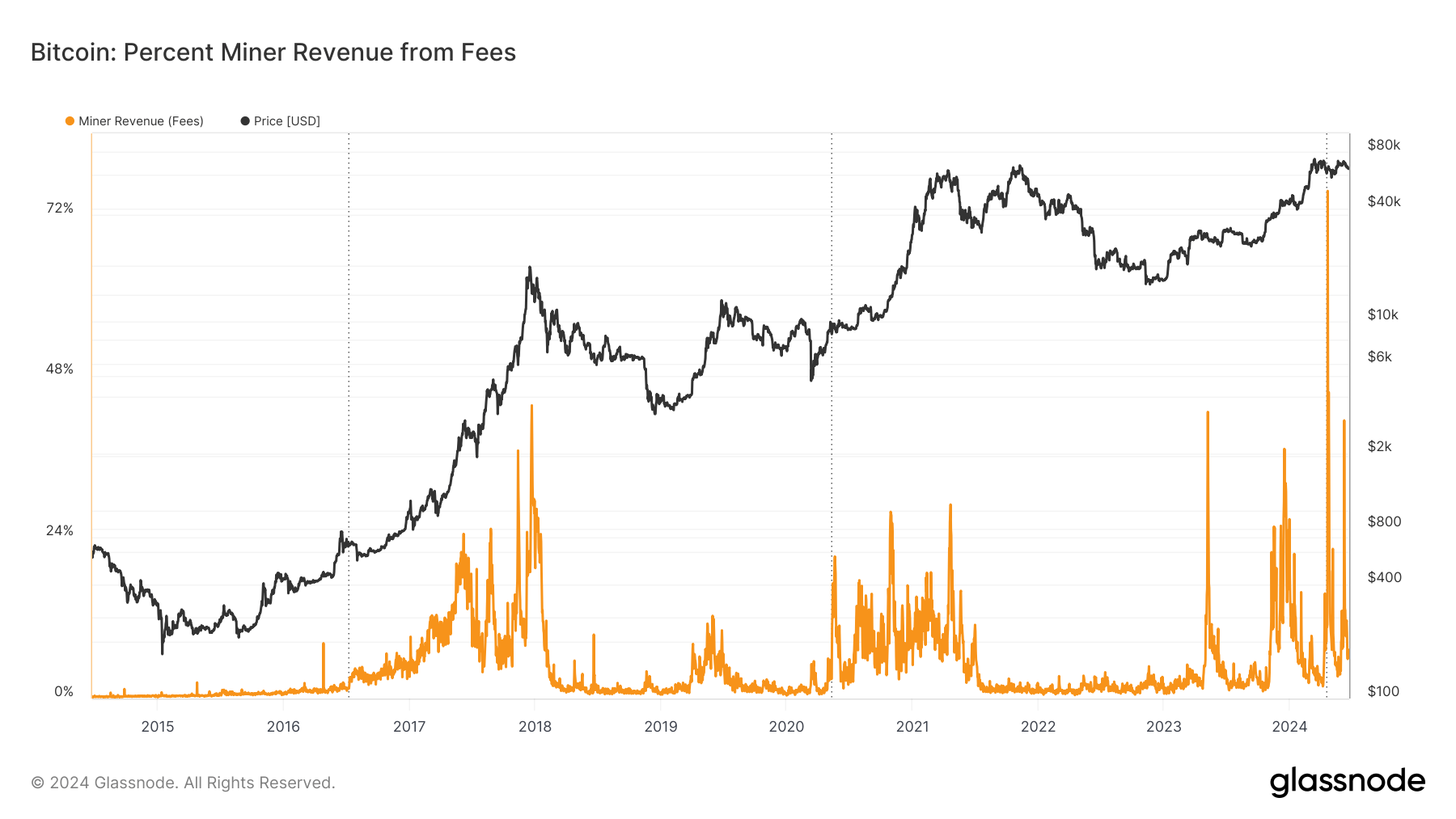

As the Bitcoin block reward is halved approximately every four years, miners increasingly rely on transaction fees to maintain their income. For instance, after the recent halving, the block reward dropped from 6.25 BTC to 3.125 BTC, significantly reducing miners’ earnings from block rewards alone. Transaction fees thus become essential for miners to sustain profitability, especially in an environment where block rewards are diminishing.

2. Revenue Variability

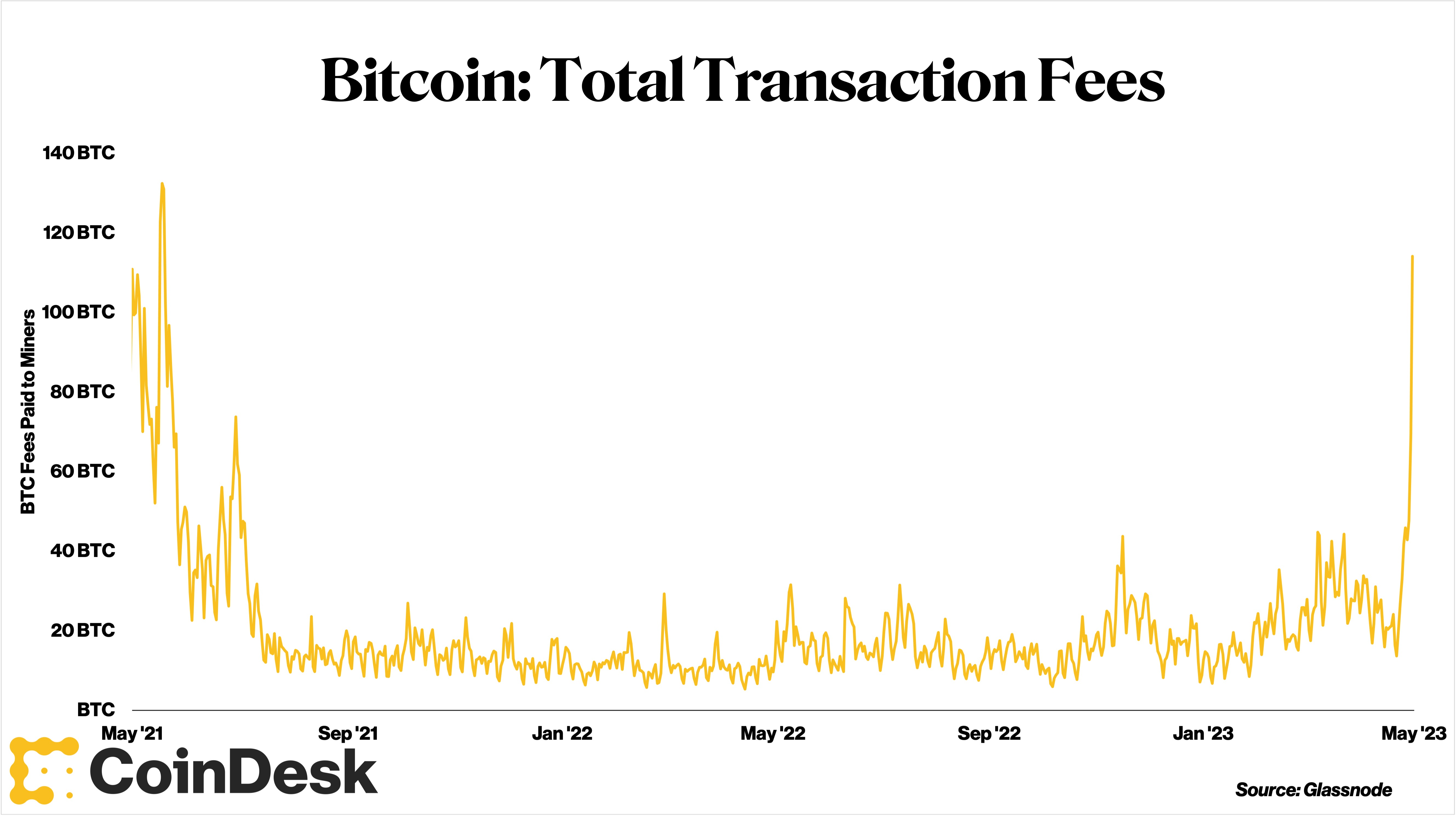

Transaction fees are influenced by network demand and congestion. When the network is busy, users may pay higher fees to prioritize their transactions, which can lead to increased revenue for miners. Conversely, during periods of low demand, transaction fees may drop, directly affecting miners’ earnings. This variability creates an unpredictable income stream that miners must navigate.

3. Incentives for Transaction Selection

Miners select which transactions to include in the blocks they mine, often prioritizing those with higher fees. This behavior is driven by the need to maximize revenue per mined block. When transaction volumes are high, miners may earn significant fees, but if they focus too heavily on high-fee transactions, lower-fee transactions may remain unprocessed, potentially frustrating users and affecting the overall network efficiency.

4. Impact of Network Congestion

In times of network congestion, transaction fees can spike, leading to a situation where only transactions with high fees are processed quickly. This can create a backlog of lower-fee transactions, which may take longer to confirm. For miners, this means they might have to balance the inclusion of higher-fee transactions against the potential revenue loss from unprocessed transactions, influencing their overall strategy and profitability.

5. Long-term Sustainability Concerns

As Bitcoin approaches its maximum supply of 21 million coins, the reliance on transaction fees will become even more pronounced. Miners will eventually depend solely on transaction fees for revenue, raising concerns about the long-term sustainability of the mining ecosystem. If transaction fees do not rise sufficiently to compensate for the loss of block rewards, many miners may find it challenging to remain profitable.

Conclusion

In summary, transaction fees are a vital component of Bitcoin miners’ profitability, especially as block rewards decrease. They provide a necessary income stream that can fluctuate based on network demand and congestion, impacting miners’ strategies and long-term viability. As the Bitcoin network continues to evolve, the dynamics of transaction fees will play an increasingly important role in shaping the future of Bitcoin mining.

Citations:

- River - How Bitcoin Fees Work

- PEP - Bitcoin Transaction Fees

- ScienceDirect - Bitcoin Transaction Fees and Mining Rewards

- CoinShares - 2024 Mining Report

- Kriptomat - What is Crypto Mining?

- Princeton University - Bitcoin Mining and Transaction Fees

- Baseline Magazine - Current Challenges of Bitcoin Mining After Halving

- Investopedia - Bitcoin Mining

comments powered by Disqus