What Challenges Do Bitcoin Miners Face Post-Halving?

Bitcoin miners today face several significant challenges that impact their profitability and operational sustainability. These challenges have intensified, particularly following recent halving events and rising competition in the mining sector.

Key Challenges

1. Increased Mining Difficulty

The mining difficulty for Bitcoin has reached record highs, making it progressively harder to mine new blocks. This increase in difficulty is a direct result of the halving events, which reduce the block rewards for miners. As the competition intensifies, smaller mining operations may struggle to compete against larger entities that can afford more advanced and efficient equipment.

2. Economic Pressures

The halving events have halved the rewards miners receive for validating transactions, which significantly squeezes profit margins. Following the most recent halving, many miners are finding it challenging to remain cash flow positive, especially those operating with higher costs. The Bitcoin price has also seen fluctuations, which further complicates the financial landscape for miners.

3. Hardware Efficiency and Upgrades

To stay competitive, miners must continually upgrade their hardware to more efficient models. The rapid pace of technological advancement means that even recently purchased equipment can quickly become obsolete. This need for constant investment in new technology creates a financial burden, particularly for smaller operations that may not have the capital to invest in the latest ASIC miners.

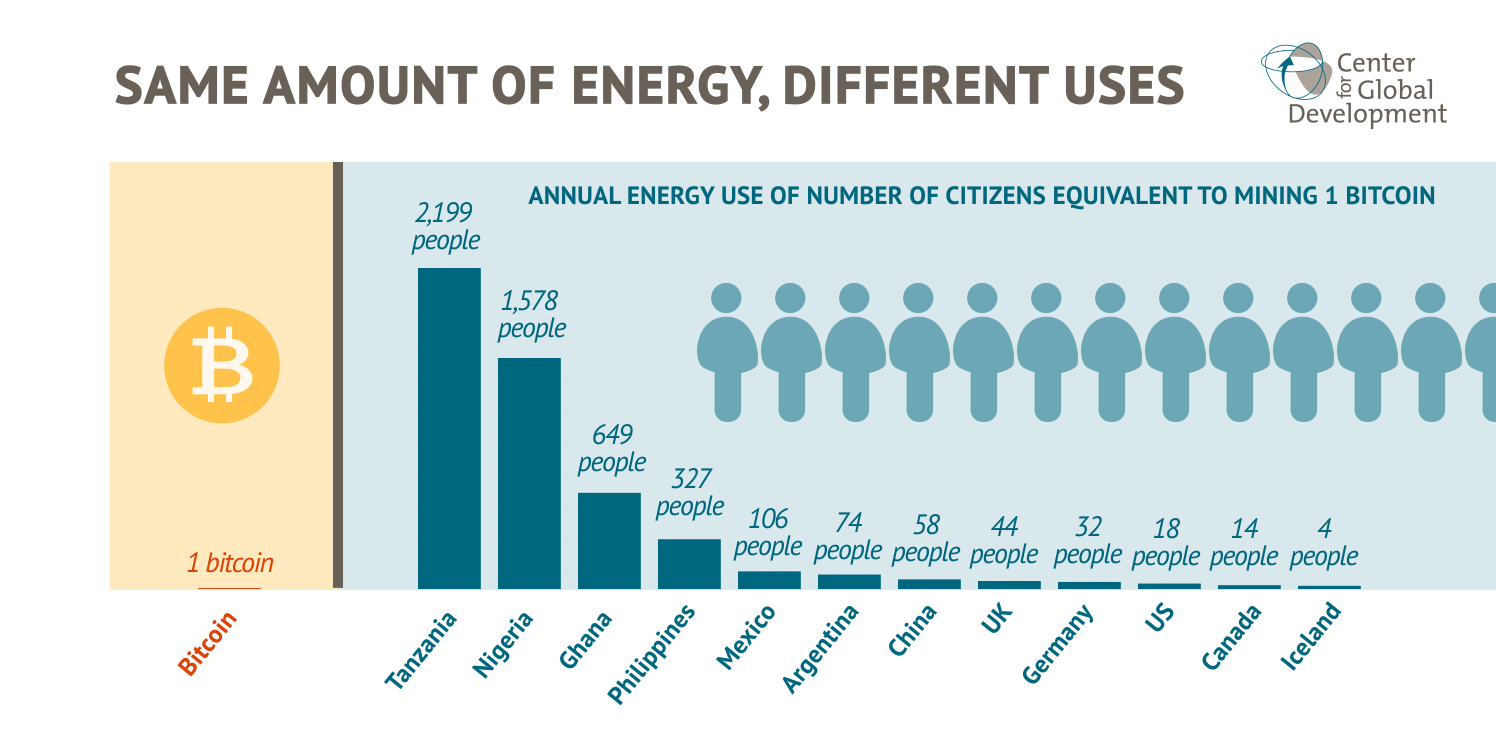

4. Environmental and Regulatory Pressures

Bitcoin mining is highly energy-intensive, leading to significant environmental concerns. Miners face increasing scrutiny and regulatory pressures due to their carbon footprint and resource consumption. As public awareness of environmental issues grows, miners may need to adopt more sustainable practices to comply with regulations and public expectations.

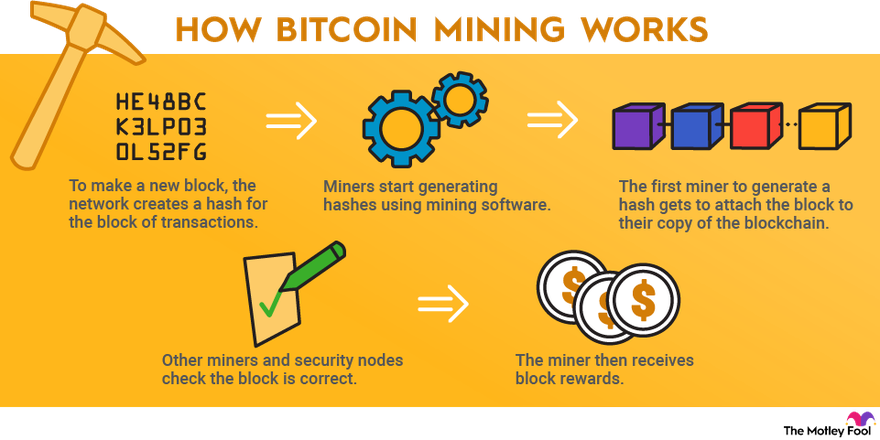

5. Network Congestion and Transaction Fees

With fewer bitcoins entering circulation post-halving, transaction fees have become a more critical revenue component for miners. However, rising network congestion can lead to increased transaction fees, which introduces volatility and uncertainty into miners’ revenue streams. This reliance on transaction fees can complicate financial planning for mining operations.

6. Market Volatility and Profitability

The profitability of Bitcoin mining is highly sensitive to market conditions. As Bitcoin’s price fluctuates, so too do the potential revenues for miners. Many miners are banking on future price increases to justify their current investments, but if prices do not rise as expected, some operations may become unsustainable.

Conclusion

In summary, Bitcoin miners today face a complex array of challenges, including increased mining difficulty, economic pressures from halving events, the need for constant hardware upgrades, environmental scrutiny, and reliance on volatile transaction fees. These factors necessitate strategic planning and investment in technology and sustainable practices for miners to remain competitive in an evolving landscape.

Citations:

- Baseline Magazine - Current Challenges of Bitcoin Mining After Halving

- TradingView - Challenges Mount for Bitcoin Miners as Difficulty Surges to Record High

- Investopedia - Bitcoin Mining

- Kriptomat - What is Crypto Mining?

- UNC Journal of Law & Technology - Bitcoin Mining and the Environmental Impact

- Koinly - Bitcoin & Crypto Mining Guide

- Unlock BC - Bitcoin Mining Difficulty Hits Record High Amid Rising Competition

- CoinShares - 2024 Mining Report

comments powered by Disqus